A QBCC letter may have informed you that your business needs to lodge annual financial information by December 31st 2024, or March 31 next year.

Category 1 licence holders and above will be required to submit the annual reporting information by 31 December 2024. SC 1 or 2 licensees must also do so by March 2025, with fines on those who don't meet deadlines.

The annual reporting is a new QBCC measure that will ensure all license holders are in compliance with the proper financial requirements. To get more information, follow the link to the QBCC’s website :

https://www.qbcc.qld.gov.au/financial-reporting-licensees/annual-reporting

Tradies Accountant can help you complete the annual report. To do this, an accountant will need to be added to your business’ myQBCC Portal to lodge the annual report. We’ve created a couple of steps to follow below. They’ll show you how to add an accountant to the myQBCC online portal so that we can complete the annual reporting submission on your behalf:

Step 1

Log in to your myQBCC account using the link below:

https://my.qbcc.qld.gov.au/s/login/

Step 2

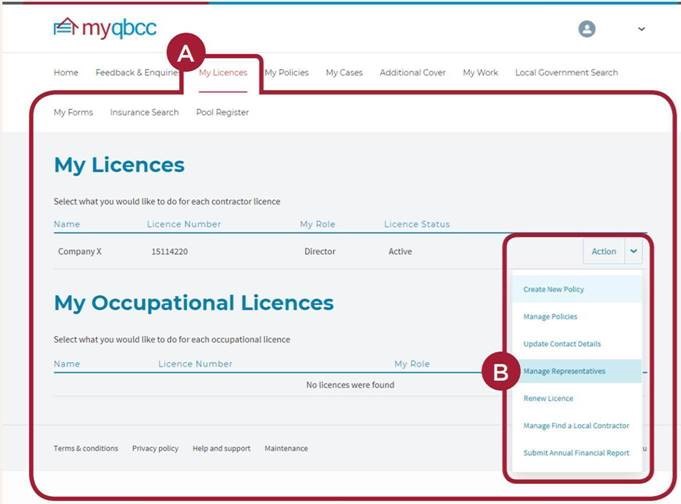

- Click on the 'My Licenses' tab

The ‘My Licences’ page will show information about all your licenses, including when they expire or were last renewed so there is no need to hunt through old paperwork again.

Step 3

B. If you click on the drop-down arrow, which is on the right of the ‘Action’ tab, it will show you a couple of options. Select “Manage Representatives’

Step 4

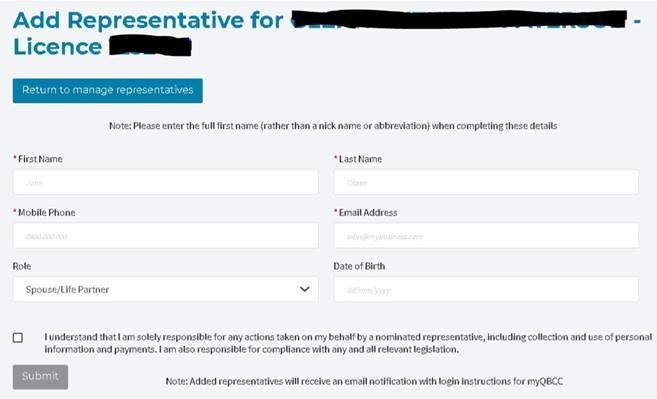

Click on “Add new representative”, enter the details of the accountant you wish to add. (Please add the relevant accountant or multiple accountants if needed)

Step 5

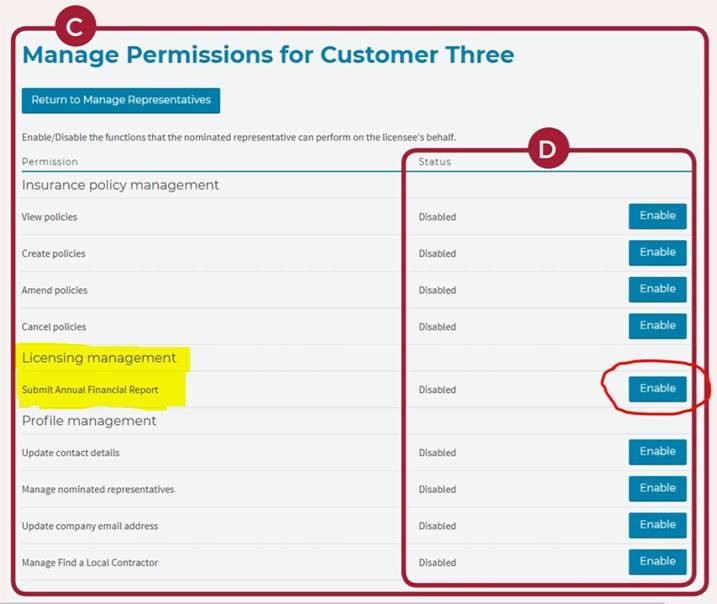

After you’ve completed entering the details, select ‘Manage Permissions’. Go to ‘Licensing Management’ and enable the accountant’s permissions to ‘Submit Annual Financial Report”.

You have the option to submit the annual report yourself. Before you do so, make sure that you satisfy all the minimum financial requirements before lodging. The financial requirements include the current ratio and the net tangible assets.

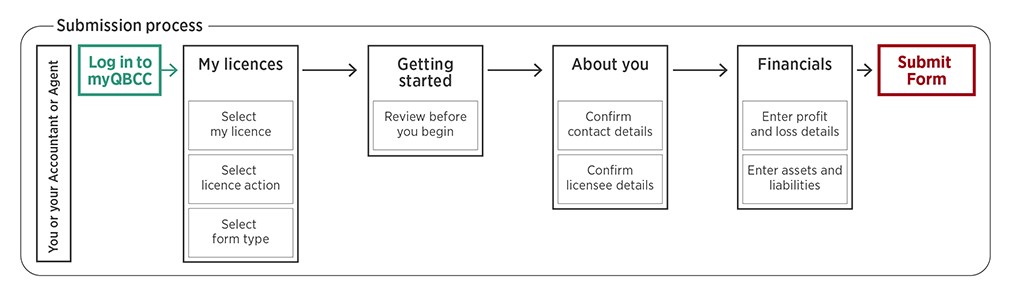

To lodge the annual reporting information with QBCC, you need to follow the steps below:

How Tradies Accountant Can Help

Tradies Accountant has accountants that are QBCC experts, specializing in trades businesses. We can assist you with any of your QBCC Annual Reporting and/or MFR reporting needs.

Contact us today to speak with one of our accountants to help get the best possible outcome with your QBCC reports.