Do you need QBCC Assistance? Fill out the Form

QBCC rules and requirements change regularly. Our team stay on top of these changes so we can provide expert advice in regards to your QBCC licence.

Licence Applications

This can be quite a time consuming process; however, use our connections, and we’ll manage the entire process for you or apply for a new licence.

QBCC Financial reporting for licensees

We’ll make sure you maintain your working licence with our MFR expertise that is accurate and on time.

Licence upgrades

We can manage the upgrade of your licence and make the transition stress-free.

Put your mind to ease with our expert QBCC specialist accountants.

Our speciality is the Trade industry, its what we do day-in and day-out, so we have our finger on the pulse to provide our clients with exceptional advice that is current and in the best interest of our clients.

We know how to support you in your business, whether that involves assisting with your accounting software, taxation advice or preparing cash flow projections.

We pride ourselves on delivering expert level industry-specific advice to our clients. If you are in the trade industry, you need to have an adviser that really understands the needs of the industry.

The Ultimate Guide About QBCC

This is a license held by individuals and businesses in Queensland to execute any building work valued above $3300.

This also includes:

- Building work priced around $1100 that implicates Hydraulic Services Design

- Any value building work that involves:

- Fire protection

- Site classification

- Drainage

- Chemical Termite Management

- Plumbing & Drainage

- Building design – low rise, medium-rise & open

- Gas fitting

- Completed residential building inspection

Please keep in mind that the cost of the building work is inclusive of material and labor costs. This does not consider the supplier of the materials.

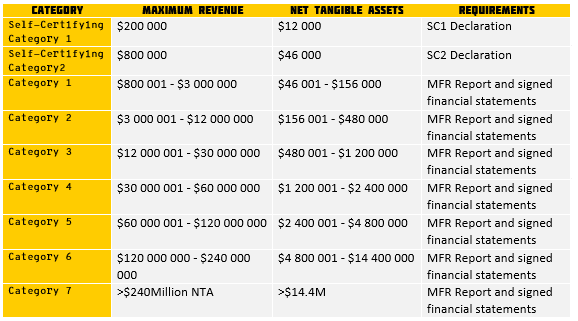

Below are the license categories along with requirements:

Your MR can be calculated by combining the net tangible assets (NTA) stated in your financial declaration. The calculation isn’t factored in to the SC1 and SC2 in bringing out the maximum revenue.

To take a look at the license classes, refer here.

Quite importantly, the Minimum Financial Requirements (MFR) Report stays the QBCC’s go-to report to be clearer about a licensee’s financial position against the mandated requirements.

Hinted on the 1st of January 2019, it was officially introduced on the 2nd of April 2019.

The requirements agreed on can be found in the table above.

- Trusts

- Employees

- Architects

Trusts

A trust will not be able to obtain a QBCC license. The company trustee will have to apply for the license.

Employees

Employees don’t necessarily need a license until they become responsible for:

- Making sure that the work follows through with the settled plans and specifications

- Directing and administrating the building work being done.

- Screening the work for competency standards.

If the work involves gas fitting, fire control, plumbing, pest control, and drainage, you’ll still need a QBCC license no matter what the value of the work is.

Architects

If you’re an architect registered through the Board of Architects, you are not required to have a QBCC license to function. This means that you’ll be able to accept building design work and perform building inspections on here various kinds of buildings. In case you’re unsure about your registration, check here.

There are also specific situations in which you don’t need a QBCC license. These apply when you’re performing work as:

- An owner. If the property belongs to you and the work being done is valued under $11 000.

- An electrician, performing electrical work. Electricians are restricted from undertaking any building work without a QBCC license. More information on this can be found here.

- An employee of a licensee. This applies in situations where your employer already has the appropriate QBCC license to cover any work you’re doing. If it is building work, you will not be allowed to function as a site supervisor except if you hold the correct license.

- An asbestos removal worker.

- A handyman. The value of the work needs to remain under $3300. It shouldn’t be plumbing or electrical work as well since these require a separate functions license.

- An insulation installer. The installation of home insulation in Queensland does not demand a license.

- An architect. Contact the Board of Architects in Queenslandfor extra information.

- A demolition worker. Visit herefor more information.

- A contractor working for a QBCC licensed trade contractor who can cover the work you’ll be doing.

For other situations that may not need a QBCC license, see Section 5 of the Queensland Building and Construction Regulation for 2003 and Section 42 for the year 1991, or you may simply contact the Tradies Accountant QBCC specialist accountant.

To avoid incorrect or unclear QBCC financial reports, it is imperative to seek the services of a QBCC specialist accountant.

Our team of expert accountants will review your financial accounts before you lodge them with QBCC.

If you’ve been dreading to open that box full of stacked receipts, you’ll be relieved to know that our QBCC accountants can help you organise these.

This will help to keep you compliant and meet all the requirements for a quick & stress-free licensing experience. At Tradies Accountant, we’re all about creating progressive and lasting relationships. If you come across QBCC problems in the future, or you just need help with your annual financial reporting, we’ll be a call away from helping you to solve them.

Contact us for solutions to your QBCC compliance issues!

Streamline Construction Project Management with Microsoft Apps

The Future of Accounting: AI in Construction Software

Revolutionize Construction with Automated Business Processes

Meet Your Team

The Tradies accounting team is your team of expert accountants and bookkeepers. We are highly qualified specialists who continually strive to remain above industry standards and ahead of the important changes and reporting requirements.

Client Testimonials

Tradies Accountant are proactive and always look for different ways to do things. We have changed from a family trust to a company which has made a great difference. We have also been able to save a heap on taxes and put more into our business. I would recommend them.

Leonard Archer

Fasteners Direct Pty Ltd

We cannot speak highly enough of everyone that we have spoken with at Tradies Accountants they have given excellent customer service, returned our calls and questions within 24 hours! We have made great decisions with Bryn after years of dissatisfaction with our previous accountants and changed from a family trust to a company which already in less than 12 months is making a huge difference. June has always been our dreaded month of anxiety because of news of the tax bill. This 2020 despite Covid-19, Kelly worked with us and provided reassurance, firstly with the tax planning, followed by inclusion and consultation of where we were financially. We were blown away with the tax savings we made this year! Kelly’s knowledge of what is happening in the world for Tradies meant all advice on tax planning was outstanding! Lacinda’s eagerness to help and Bryn’s quarterly reviews help us plan for retirement confidently. Highly recommend Tradies Accountant!

Julie & Rob

C.B.R

The transition of accounts team has been made really smooth with Bryn and his teams help. Especially Janine, we have been blown away by all her efforts and how quickly she has dived into working with our processes. It has made everything in the office a lot less stressful knowing the financials are being managed by a fantastic team

Corbin Steinmuller

Operations Manager, RJM Builders

I write this review with great reluctance. I do not want anyone else know how Thea and Tradies accountant has transformed our weekly payroll of paying 25 staff, everyone being on different agreements and awards, into a streamlined, no stress, well organized task.

Angela Stevenson

Danlaid Contracting