Job costing is the best way for you to increase your profit and cash flow. This means you need to track the profit of individual jobs. For example, any single job may involve differing costs of labor and materials. You need to work these out and allocate the materials and labor to each job. Once you have completed this task you need to make sure you can easily see the breakdown of invoices and expenses on the job. That way you can work out your gross profit margin. Electricians and plumbers usually have similar gross profit margins. Once you understand what the margin is, you should be able to compare your margin to the industry average.

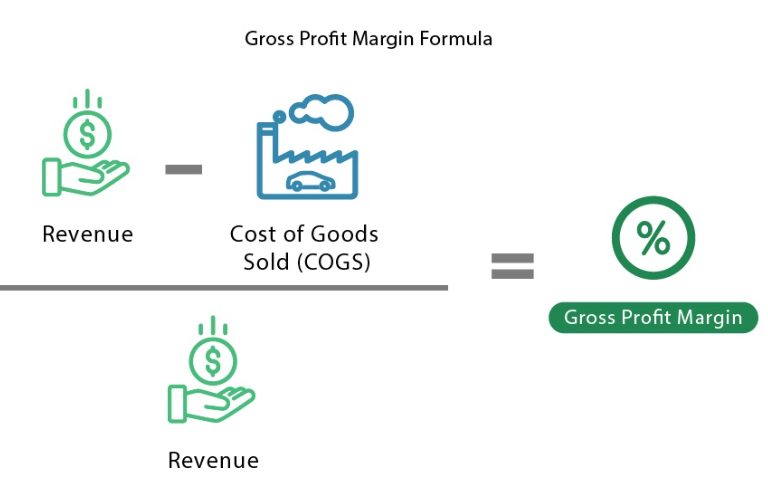

We have seen a lot of clients that are including direct costs in overheads and this means that you cannot see your gross profit margin. This is dangerous because you do not know where you are losing money and how to improve the performance of your business. The simple formula for gross profit margin is below:

There are a lot of programs on the market that can do this task for you effectively. This means you can input the quotes and then set budgets on jobs. After this you can track all of the expenses to the job. This will enable you to realise how much profit you are making from each job and if there are any jobs that are causing you to lose money. These programs are very useful; however, like any system they require investment. Without the correct investment for set up – you may have a cheap system that does not work.

At Tradies Accountant, we work with a lot of clients and help them decide on the best program to use for their business. The first step is to understand the type of jobs you do predominately, if they are commercial jobs they require different systems than residential “do and charge” jobs. The second step is to work out how much resource you have internally to use the system or do you need to outsource to another provider that will help you enter the data into the system. The third step is to work out how much the new system will cost.

Another option is to get your accountant to help you work out your cost of goods sold and see if your current accounting system can do the above task. A lot of the time the actual tracking is in the way you use your systems and processes. You can buy the best system on the market but if you are not using it effectively you are wasting your money. There are ways you can track through Xero and Quickbooks. This may not work for every client but it is definitely an option.

At Tradies Accountant we have worked with numerous clients through this process and the advantage of using us is we understand the industry. This means you will make the correct decision and not waste time and money purchasing something that does not work.

If you would like our help, just let us know. We are more than happy to give you a helping hand and even better, we are well versed in the costing process of the industry. We also have a free bookkeeping guide you can follow practically to help your growing trade business. You can download it below.